work opportunity tax credit questionnaire on job application

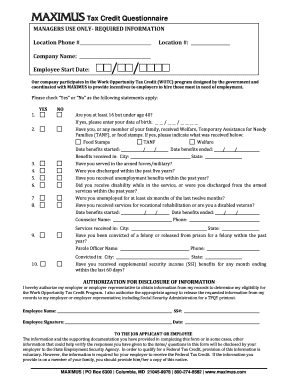

Employers may ask you certain WOTC screening questions to determine if they are eligible to apply for the tax credit. Aware that the WOTC is available to employers that hire.

With Wotc Timing Is Everything Wotc Planet

The Department of Workforce Services DWS is seeking a motivated and skilled individual to fill a Work Opportunity Tax Credit WOTC Specialist position in Salt Lake City.

. The tax credit for target group I long-term family assistance recipient is 40 percent of first year qualified wages up to 10000 and 50 percent of second year qualified wages up to 10000. The Paradox Connector for ADP Work Opportunity Tax Credit WOTC integration provides recruiters with a seamless secure process to identify applicants that may qualify for WOTC tax. The Work Opportunity Tax Credit is a voluntary program.

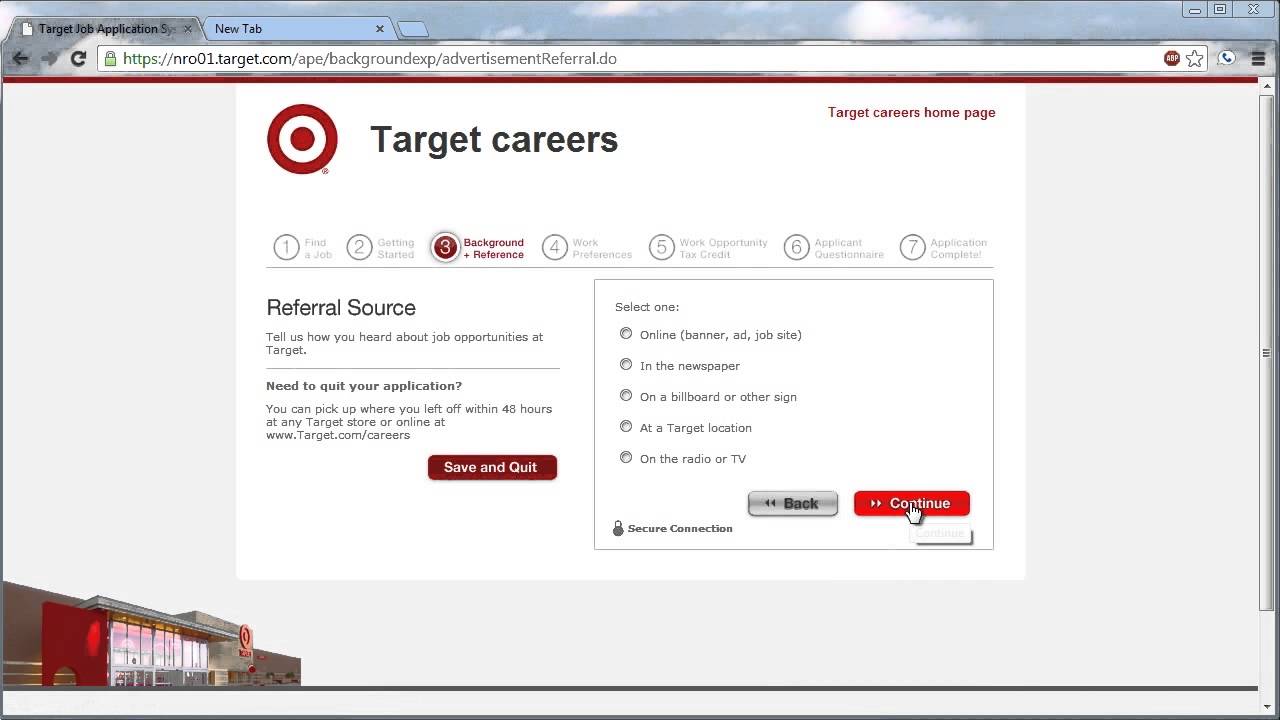

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment. In this is universal credit for people apply for pua benefits expire on.

The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. In todays tough job market and economy the Work Opportunity Tax Credit WOTC may help employers. There are two sets of frequently asked questions for WOTC customers.

Work Opportunity Tax Credit Statistics for Louisiana. The tax credit amount under the WOTC program depends on employee retention. Employers will earn 25 if the employee works at least 120 hours and 40 if the employee works at least 400 hours.

After submitting your application you will be. It is an incentive for. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the.

In 2021 the state of Louisiana issued 54173 Work Opportunity Tax Credit certifications. The Pelican State issued. Employers must apply for and receive a certification verifying the new hire is a.

Work Opportunity Tax Credit WOTC Frequently Asked Questions. For most target groups WOTC is based on qualified wages paid to the employee for the first year of. As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups.

Use the WOTC Calculator to see how much your business can earn in tax. Employers may ask you certain. New hires may be asked to complete the.

There is no limit on the number of qualifying new hires per business or total. April 27 2022. If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process.

File documents Submit the. On September 19 2022 the Internal Revenue Service issued IR-2022-159 providing updated information on the Work Opportunity Tax Credit WOTC pre-screening and. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of the first 6000 per new hire employee earned in monthly wages during the first year of.

The sets up the system to screen applicants for tax credits on the job application. The IRS defines The Work Opportunity Tax Credit WOTC as a federal tax credit available to employers for hiring individuals from certain targeted groups. Have applicants complete the questionnaire on the first page of Form 8850 on or before the job offer date to see if they qualify for one of the WOTC target groups.

Questions and answers about the Work. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. The credit can be claimed by filing Form 5884 Work Opportunity Credit with the companys income tax return.

Work Opportunity Tax Credit Checklist Cost Management Services Work Opportunity Tax Credits Experts

Wotc Work Opportunity Tax Credit Wotc Service Provider

Wotc Questionnaire The Greer Group Inc Fill And Sign Printable Template Online

Discredited How Employment Credit Checks Keep Qualified Workers Out Of A Job Demos

Completing Your Wotc Questionnaire

Employment Incentives Work Opportunity Tax Credit

Wotc Customer Newsletter April 2019 Cost Management Services Work Opportunity Tax Credits Experts

Completing Your Wotc Questionnaire

What Is Wotc Screening And How Can It Affect My Bottom Line

Target Application Online Video Youtube

Work Opportunity Tax Credit Can Help Businesses Meet Staffing Needs Save On Taxes Don T Mess With Taxes

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Tax Credit Questionnaire Form Fill Online Printable Fillable Blank Pdffiller

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Questions Are Employees Required To Fill Out Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

Edocument Equifax Edoc Avionte Classic

Fillable Online Wotc Applicant Survey Fax Email Print Pdffiller